Successful tech startups are born with a clear scope to invent a product, a service, or disrupt an industry. As they do, they often end up changing lives, livelihoods, and the fabric of society for decades to come, impacting societal behaviors at scale. But not always for the better.

As a growing pool of venture capital brings exponential growth, scale, and reach to innovators – leading to a booming birth rate of tech unicorns – and as stakeholders increasingly demand environmental and social leadership from companies, we are convinced that the time is now for venture capital to make purpose a core tenet of its approach to scaling the tech leaders of tomorrow.

THE CONTEXT

In 2021, the venture capital market in the U.S. alone surpassed the combined total of the past five years together, with $71 billion invested in over 340 unicorns. With Asia still holding second place by investment value and unicorns generated, Europe is seeing exponential growth, with 120 unicorns born by the end of 2021. Globally, more than 1,100 unicorns have been born to date, representing a total value of around $3.8 trillion, up by $1.8 trillion compared to the end of 2020. In general, valuations, investment amounts, and round sizes of venture capital investments increased in 2021, demonstrating the strength and momentum of an industry offering unprecedented growth opportunities for founders and innovators.

While the environment is exciting, growing, and evolving, the track record of several former unicorns directly increases our concern on whether successive unicorns can align rapid growth with embracing an authentic sense of purpose. Successful tech startups evolve to scale a product, but a product is not a purpose, rather one of the enablers through which the company can bring its purpose to life. Without a deliberate effort to define its purpose and use it as a lens for strategy and decisions, a unicorn may quickly morph into a beast under the forces of rapid growth, leading to unexpected outcomes and deteriorating stakeholder trust.

Purpose is not just about avoiding unintended consequences from unfettered growth or unexamined practices. Purpose is also a lever that unlocks better long-term performance: purpose-driven companies are proven to better attract talent, maintain clarity of strategy, align the organization on a shared vision, and outperform the competition in the long term.

WHAT IF EXPONENTIAL GROWTH WAS IMPLICITLY PURPOSE-LED?

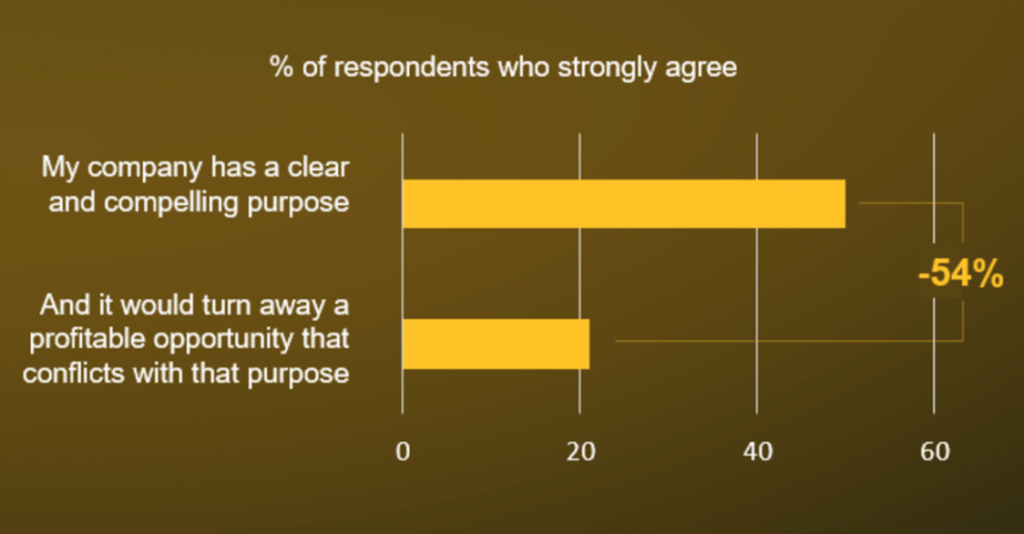

As our colleagues analyzed in a publication back in 2019, purpose is a topic of daily worry for the tech industry, with former unicorns and leading tech companies demonstrating a big disconnect between having a definitive purpose and living it. While almost half of tech company employees that responded to our survey said their company has a clear and compelling purpose, just over 20% of them stated that the company would turn away a profitable opportunity that conflicts with that purpose.

Since their earliest stage, when they were budding startups aiming at the next record-setting private funding round, leading tech organizations implicitly embedded a growth-at-all-costs attitude. If not balanced to a strategic consideration of the company’s evolving role in society – and a coherent adaptation of its business model, operations, and culture – that mindset faces the risk of massive societal costs, including misinformation, security concerns, and declining trust, to name a few.[1]

Respondents from 15 leading tech companies

Source 1

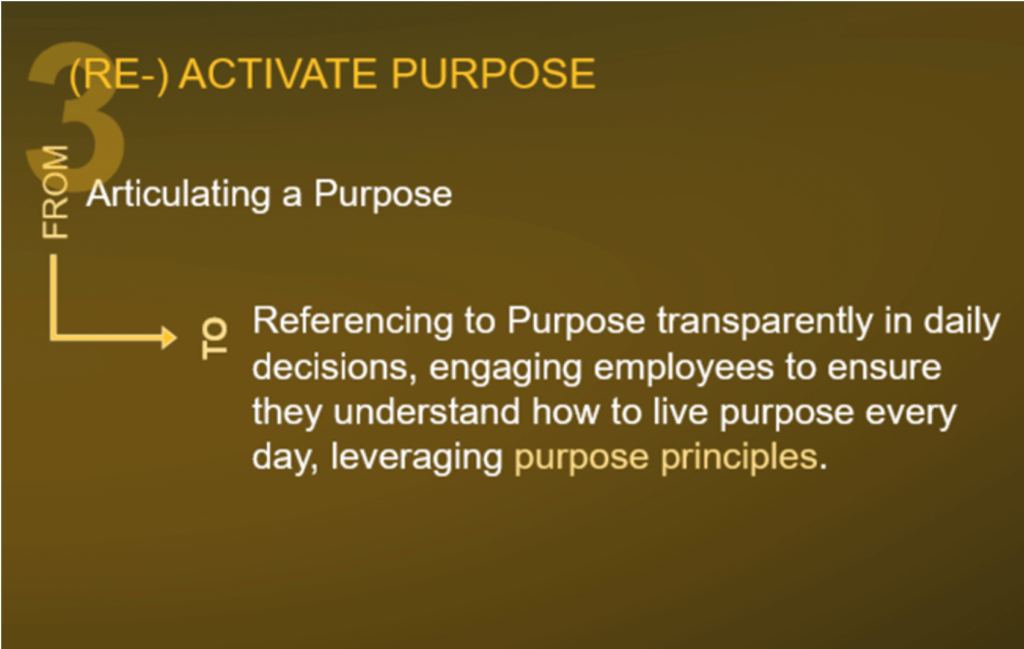

The rapid growth of tech companies, coupled with the inherently disruptive nature of their innovation, allowed them to quickly change the fabric of society, entering a dangerous zone where unexpected outcomes are most likely to happen. When Twitter co-founder, Jack Dorsey, was heard in the U.S. Congress back in 2018 on accusations of not providing enough account transparency during the U.S. 2018 elections, he replied, “We were not expecting any of this when we created Twitter 12 years ago. We acknowledge the negative consequences, and we take the full responsibility to fix it.” Precisely, as LinkedIn co-founder Reid Hoffman recently stated in a talk on purpose with The British Academy, “to intervene in this [societal level] space, a tech firm should ask itself whether it has the moral authority to do that. If so, it has to exploit its resources and capabilities to improve over time and ensure the achievement of its purpose on the long-term, by establishing purpose principles and measuring them”.

Purpose principles are the pillars that are authentic to a company’s DNA and which, as such, do not change in time. In fact, as mentioned by Doug Leone, Global Managing Partner at Sequoia Capital – a global VC firm that invested in the earliest stages of companies like Google, Zappos and PayPal – during a lecture on vision and culture, “[for their teams to thrive], leaders should write business plan with a pencil, but principles with an indelible pen: those, once authentically defined, will not change in time.”

Losing sight of a company’s true purpose happens fast – discovering and deeply embedding it in the organization takes time, effort, and courage. The entities that allow tech pioneers’ magic and vision to become a reality – aka venture capitalists – are also those best suited to ensure a unicorn’s growth is deeply purpose-driven from the start. But why venture capital exactly? And how can these entities get there?

VC COMPANIES CAN DO MORE TO DRIVE PURPOSE IN TECH

Venture capital has reached unprecedented levels of growth, establishing itself as an influential lever for change in the tech industry. Much of the sector is also increasingly interested in the societal role of its portfolio companies. According to Atomico’s 2020 State of European Tech report, almost 80% of European VCs agree that “technology entrepreneurs will do more to address societal challenges in the next decade than European governments.” Atomico’s Partner, Tom Wehmeier, describes that venture capital must “embrace a purpose-driven approach to building and scaling.”

VC’s interest in portfolio companies’ impact is growing, and the excitement is led by the opportunity for its economic upside. As the CEO of asset manager BlackRock, Larry Fink recently stated in his 2022 Letter to CEOs, “putting your company’s purpose at the foundation of your relationship with stakeholders is critical to long-term success.” Organizations with a strong sense of purpose are more than twice as likely to have an above-average Total Shareholder Return (TSR)[2], outperforming competitors in the long run and solidifying stakeholder trust. Moreover, embedding purpose serves as a protection from the downside risk of investments losing their social license to operate and facing other costs (i.e., litigation), which result from a failure to consider the role in society of portfolio companies.

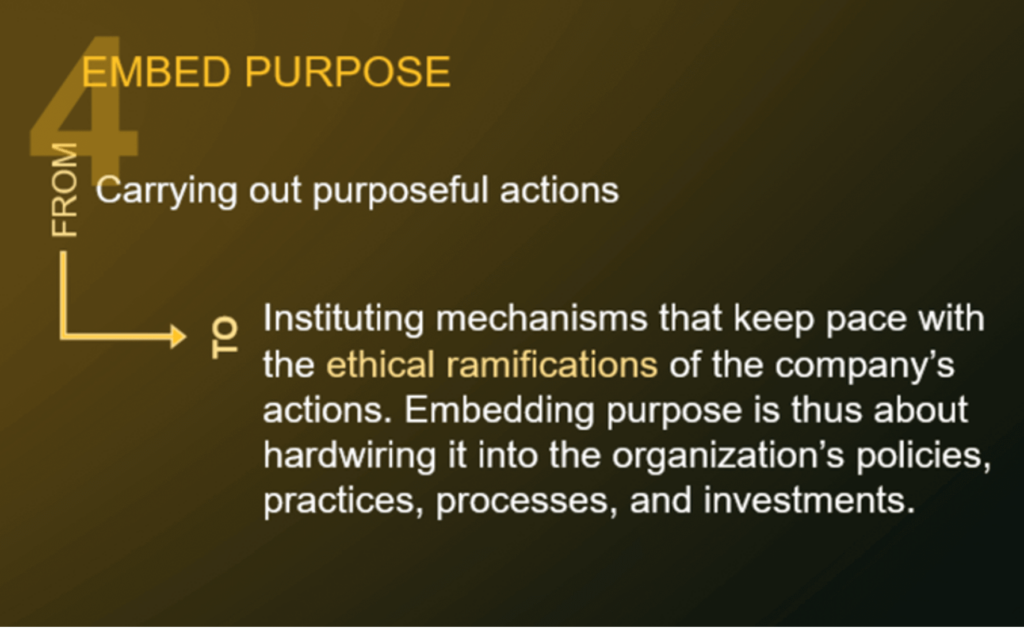

However, awareness is insufficient to embrace long-term performance. To effect change, VC companies must formalize their commitment to purpose across their portfolios, insisting that their investments go through a rigorous purpose process, tie business decisions to purpose, report on a scorecard of non-financial metrics, and align their culture to the purpose they seek to achieve.

HOW THE POWER OF PURPOSE CAN BE RELEASED IN PORTFOLIO COMPANIES

As stated by Michael Moritz, Partner at Sequoia Capital, during a fireside chat with Stanford Graduate School of Business, “having a sense of where your compass is heading, where it’s set, and never losing sight of eventually where you want to go, by breaking it down into all sort of steps, is the biggest thing that has helped us and helped some of these companies that we’ve had the good fortune to be involved with”.

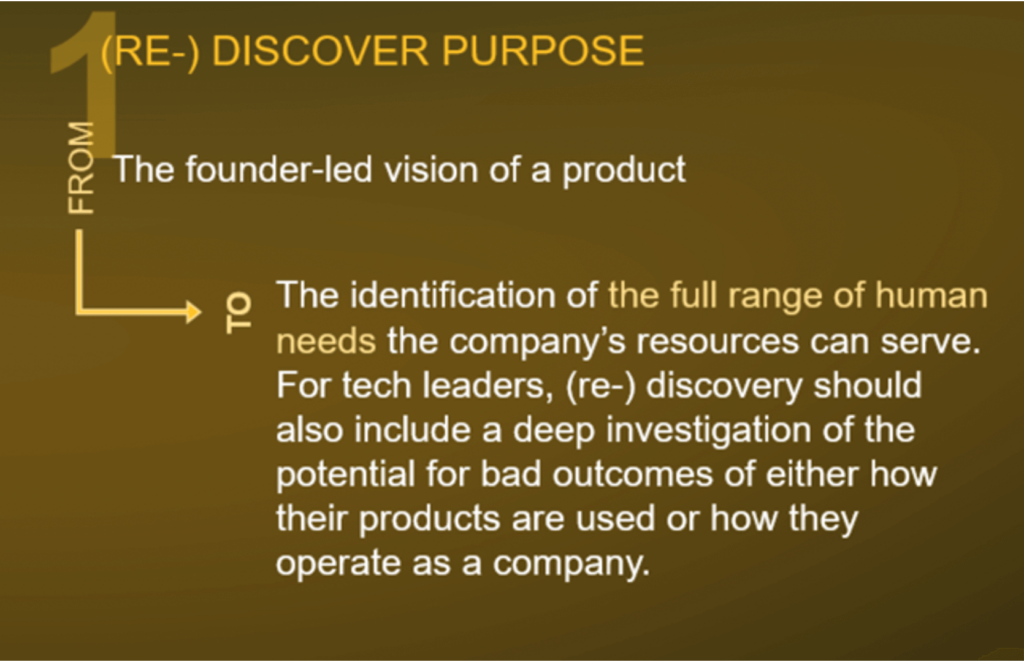

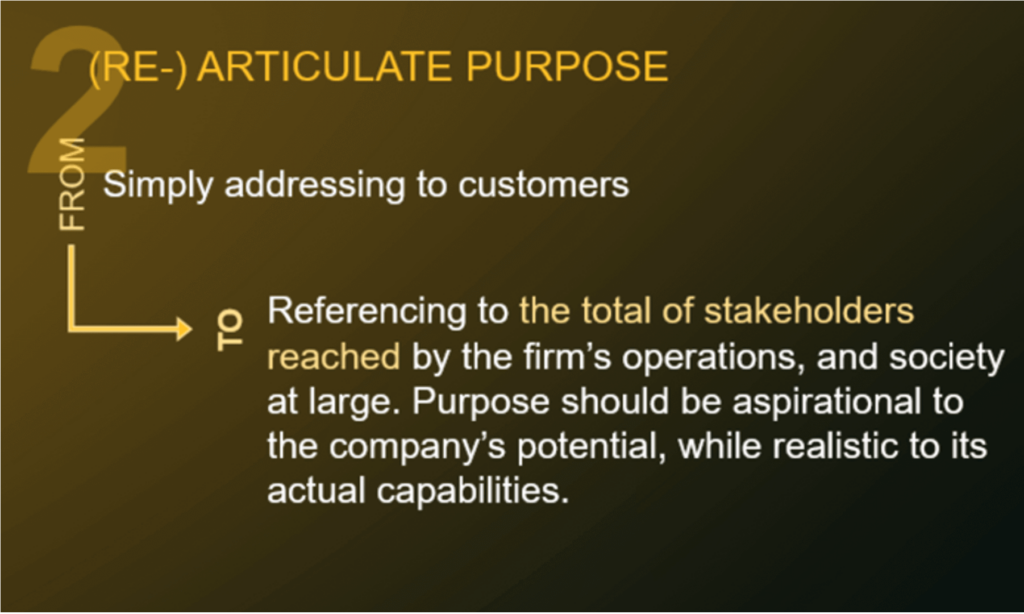

As actors who offer guidance on growth, scale, and major business decisions of portfolio companies, venture capital players can steward future unicorns to discover and integrate their unique North Star. To make this vision a reality, VCs can take the following steps to walk their companies toward a purpose-driven strategy:

CONCLUSION

Tech unicorns – and the venture capital funds that nurture them – have the power to invent products and services, disrupt industries, and revolutionize society. To ensure they create durable, long-term results while serving society in a positive way, they need to align their growth objectives with a clear, compelling, and constant sense of purpose. This is how it is possible to ensure that the next generation of unicorns live up to their promise and avoid the many pitfalls of purpose-less growth.

[1] Solving the Tech Industries Purpose Problem

https://www.bcg.com/publications/2019/solving-tech-industry-purpose-problem

[2] BCG BrightHouse research